Published Jan 12, 2026

How 1440 Turned Channel Confusion into Confident Scaling with BlueAlpha's Action System

See how 1440, one of the fastest-growing newsletters in America, went from second-guessing every marketing dollar to scaling Meta spend with total confidence.

Marketing Mix Modeling

Fast Facts

Industry: Digital Media / Newsletter Publishing

Company: 1440 - Daily news digest reaching millions of readers

Challenge: Couldn't prove which channels actually drove subscriber growth; unable to measure organic social; trapped in conflicting attribution data

Solution: BlueAlpha's weekly MMM with quality adjustments and organic social integration

Results

"Strong+" statistical correlation proven between Meta spend and subscriber signups

Meta validated as the primary growth driver: 59.8% of total attribution, lowest CAC

LiveIntent eliminated after MMM revealed negative correlation with growth

Organic social measured for the first time - YouTube, Facebook, X, and Instagram organic now tracked

Decision confidence from weekly model updates instead of quarterly guesswork

~$650K/month Meta spend scaled with data-backed conviction

The Situation: Growing Fast, Flying Blind

1440 is not your typical newsletter. With 4.46 million subscribers and a goal of hitting 5 million, they've built one of the most successful daily news digests in America. Their audience trusts them for concise, balanced news coverage every morning.

Their marketing team, led by Erika Burghardt, ran a sophisticated multi-channel operation: Meta ads (Facebook and Instagram), LiveIntent, beehiiv, Google properties (Search, PMax, YouTube), and affiliate partnerships. They tracked everything. They had dashboards. They had platform reports.

What they didn't have was confidence.

"We were spending over $100K per week on Facebook alone," Erika explained. "The platform said it was working. GA4 said something different. Our internal attribution had a third story. When the CEO asked 'should we spend more on Meta?' the honest answer was 'we think so, but we can't prove it.'"

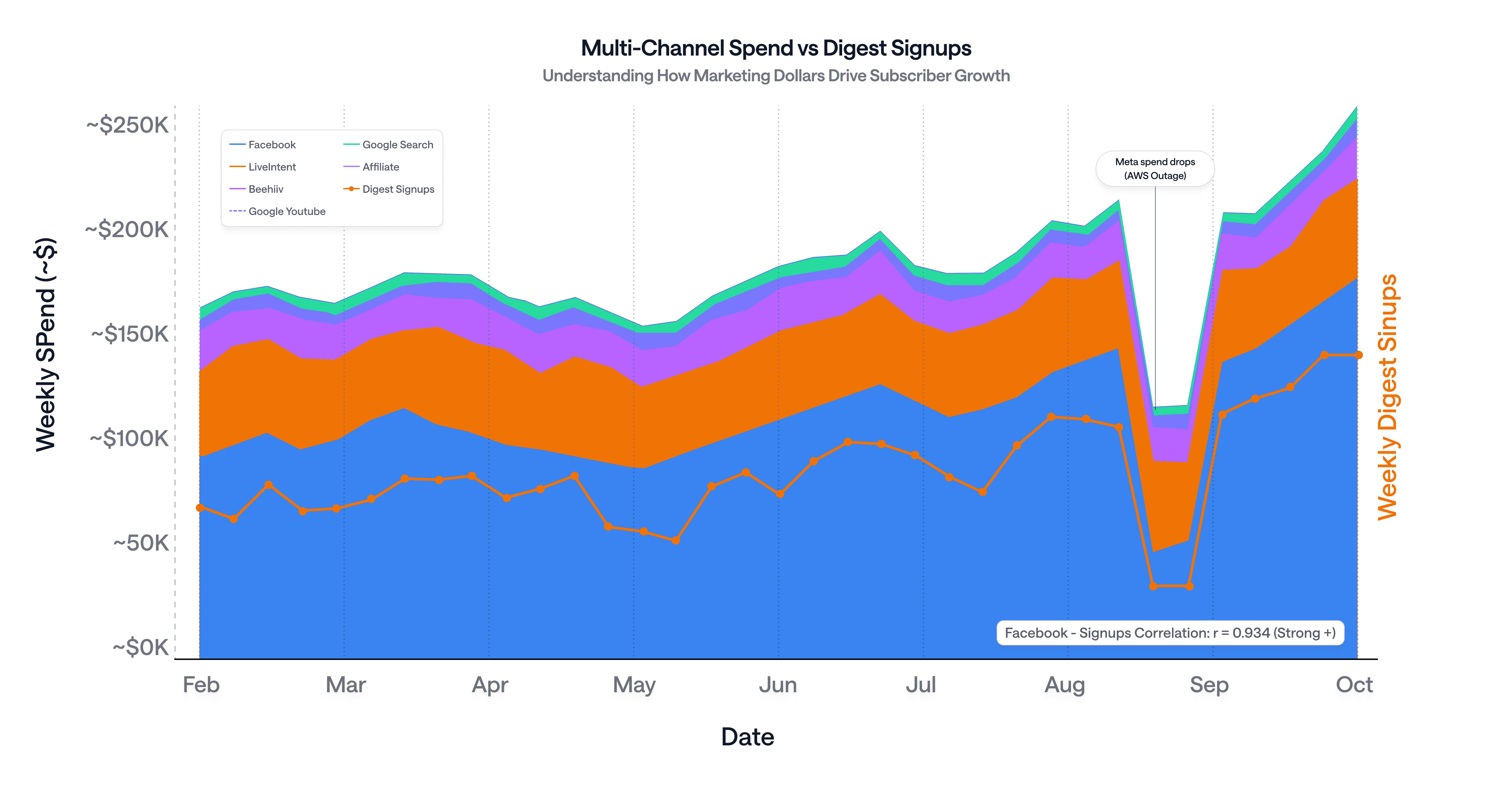

1440's weekly marketing spend by channel (Feb-Oct 2025). Note how digest signups track closely with Facebook spend changes while other channels remained relatively flat.

The problem extended beyond Meta. LiveIntent was the second-largest spend category, but the team couldn't determine if those dollars drove new subscribers or simply reached people who would have signed up anyway. Google PMax showed conversions, but were they incremental? And organic social - Instagram posts, Facebook content, YouTube videos - remained a complete black box.

The Challenge: Trust Deficit in a Data-Rich Environment

1440 faced a paradox common among sophisticated marketing teams: more data led to less clarity.

The attribution problem: Platform-reported metrics told one story. Last-click attribution told another. Multi-touch models told a third. None could answer the fundamental question: if we increase spend on Channel X, will we actually get more subscribers?

The organic blind spot: 1440 invests significantly in organic content - roughly 7 posts per day across Instagram and Facebook, weekly YouTube videos, and a growing broadcast channel presence. None of this appeared in any measurement system. It was simply lumped into "baseline" and ignored.

The quality question: Not all subscribers are equal. A $2 subscriber who never opens the newsletter is worth less than a $4 subscriber who engages daily. 1440 tracked payback rates by channel, but this data lived in Redshift, disconnected from their attribution models.

The speed problem: Traditional MMMs update quarterly. In a fast-moving media environment where CPMs shift weekly and algorithm changes happen without warning, quarterly insights arrive too late to act on.

The result: paralysis. Major budget decisions got delayed. Test results sat in spreadsheets. The team knew Meta was probably their best channel, but "probably" doesn't justify a 2x budget increase.

The Solution: BlueAlpha's Marketing Action System

BlueAlpha approached 1440's challenge differently. Instead of building another dashboard, they deployed an action system designed to answer three questions every week:

What happened?

Why did it happen?

What should we do next?

Phase 1: Data Architecture and Integration (August 2025)

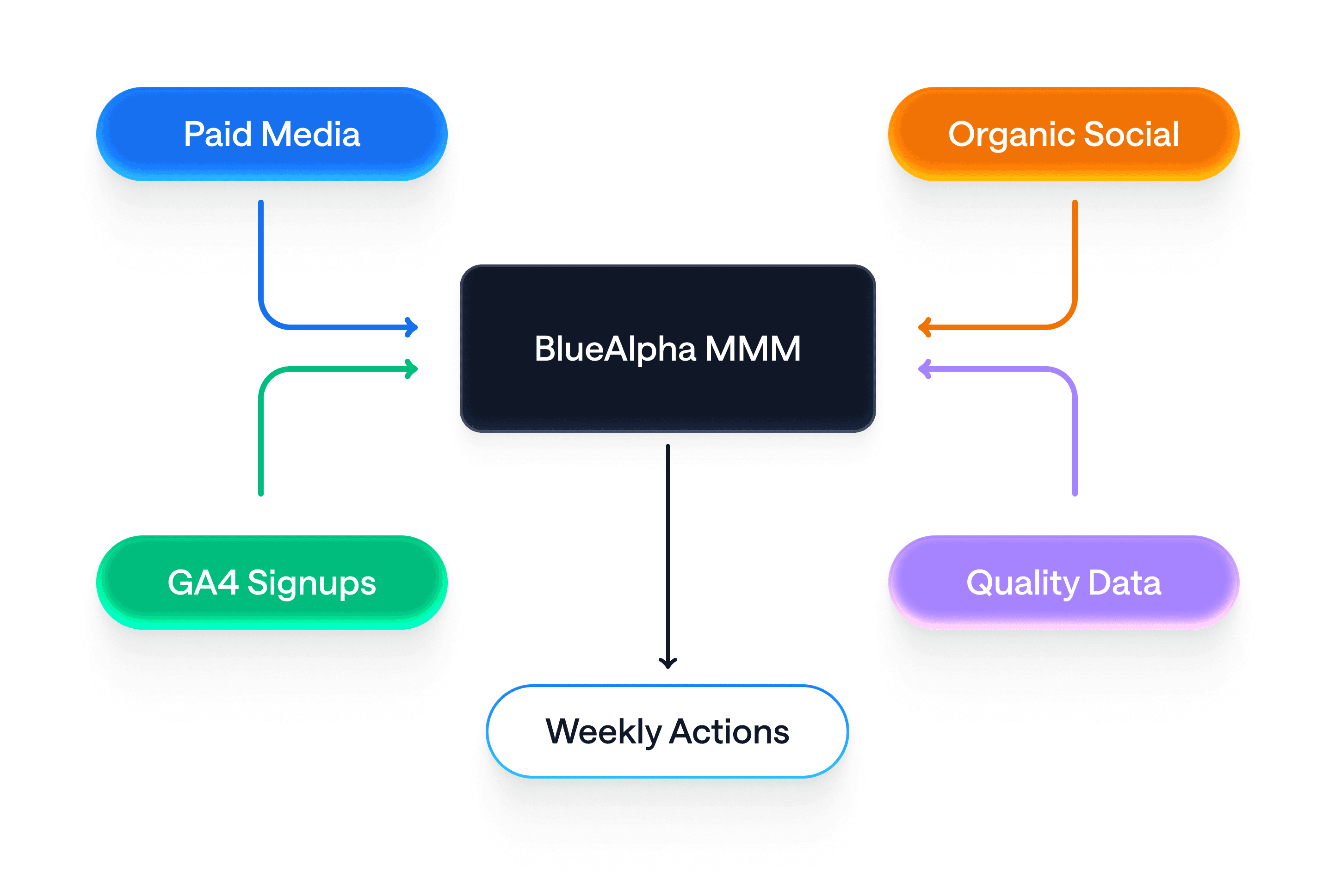

The engagement began with rigorous data scoping. BlueAlpha connected:

Paid media: Google Ads, Meta Ads, TikTok (paused), LiveIntent API, beehiiv spend sheets, X and Jeeng historical data

Outcomes: GA4 sign-up events filtered to Daily Digest subscribers only

Quality metrics: Redshift payback tables showing revenue per subscriber by channel

Organic social: YouTube Analytics, Facebook, X, and Instagram engagement metrics (later integration)

1440's complete data architecture (paid platforms, first-party analytics, and quality metrics) unified by BlueAlpha in a single measurement system.

Phase 2: Bayesian MMM with Quality Adjustments (September 2025)

BlueAlpha's model wasn't a standard MMM. Key methodological choices:

Spend variance correlation: The model attributed conversions based on how spend changes correlated with outcome changes - fundamentally different from last-click attribution (that simply credits the last touchpoint).

Quality-adjusted response curves: Raw subscriber counts tell half the story. BlueAlpha integrated payback rate data to answer: "What's the revenue quality of subscribers from each channel?" This revealed that beehiiv subscribers had 2.3x higher quality than Facebook subscribers, even though Facebook's raw volume was far greater.

Dynamic weekly updates: The model refreshed every week, adapting to new data patterns, seasonal shifts, and campaign changes. This wasn't a static report - it was a living system that learned.

The first results presentation to 1440's entire team showed something the platforms couldn't: a clear hierarchy of channel value adjusted for both volume and quality.

Phase 3: The Accidental Experiment (October 2025)

During October 2025, 1440's CEO directed the team to aggressively scale Facebook spend. A week later, an AWS outage took Facebook ads offline temporarily.

BlueAlpha's model captured what happened next.

When Meta went dark, subscriber growth dropped. When spend scaled back up, growth followed. This wasn't correlation in a spreadsheet - it was real-time causal evidence visible in the model.

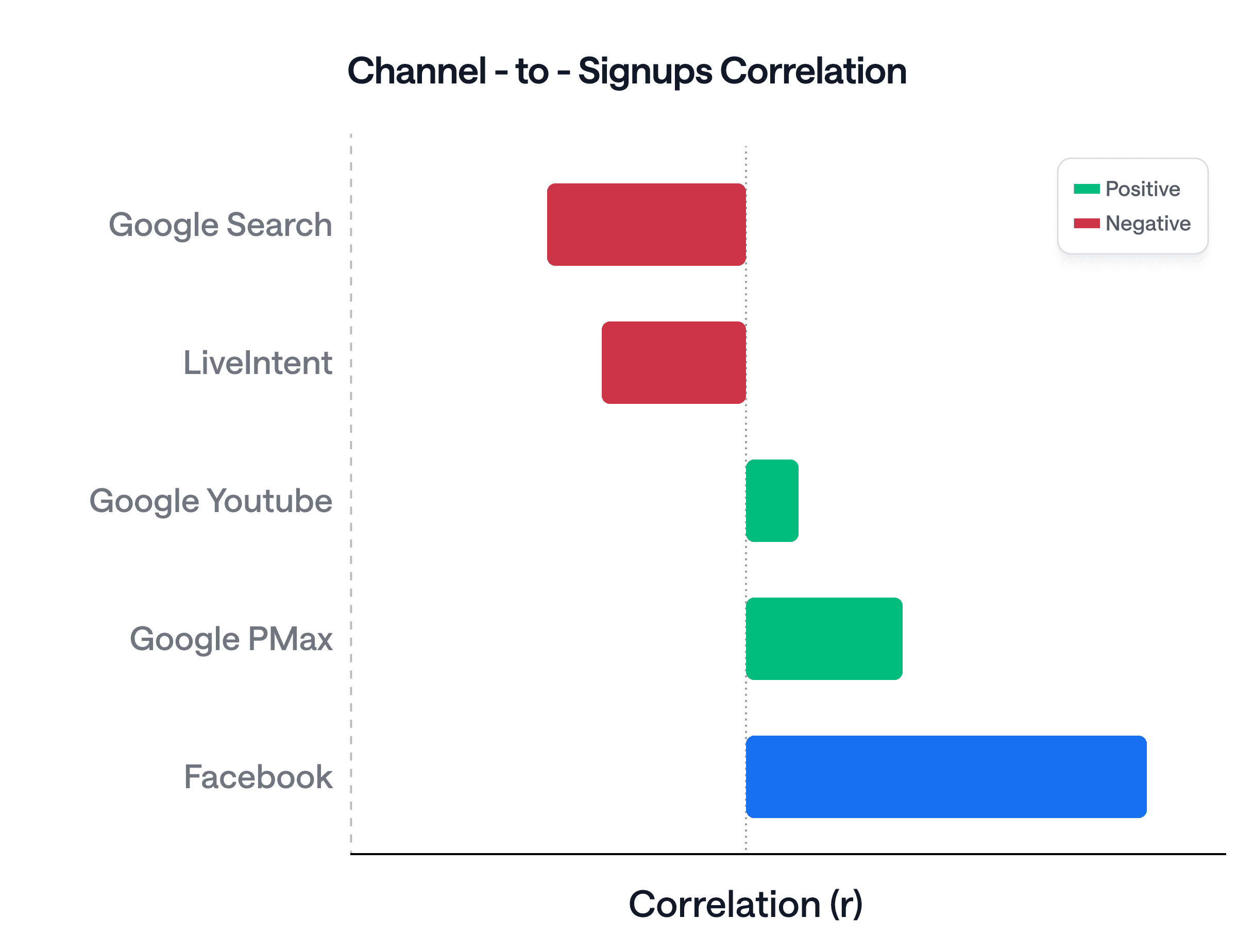

13-Week Spend-to-Outcome Correlation Analysis:

Last 13 weeks of spend-to-outcome correlation analysis. Facebook's correlation classifies as 'Strong+' - the highest confidence level in BlueAlpha's framework.

The data was unambiguous. Meta wasn't just working - it was the primary growth engine. And LiveIntent, despite consuming nearly $400K over the period, showed a negative correlation with subscriber growth.

Phase 4: Organic Social Integration (October 2025)

With paid channels mapped, BlueAlpha tackled 1440's organic blind spot. The team integrated YouTube, Facebook, X, and Instagram organic engagement data into a new model variant: "Digest Organic."

The impact was immediate:

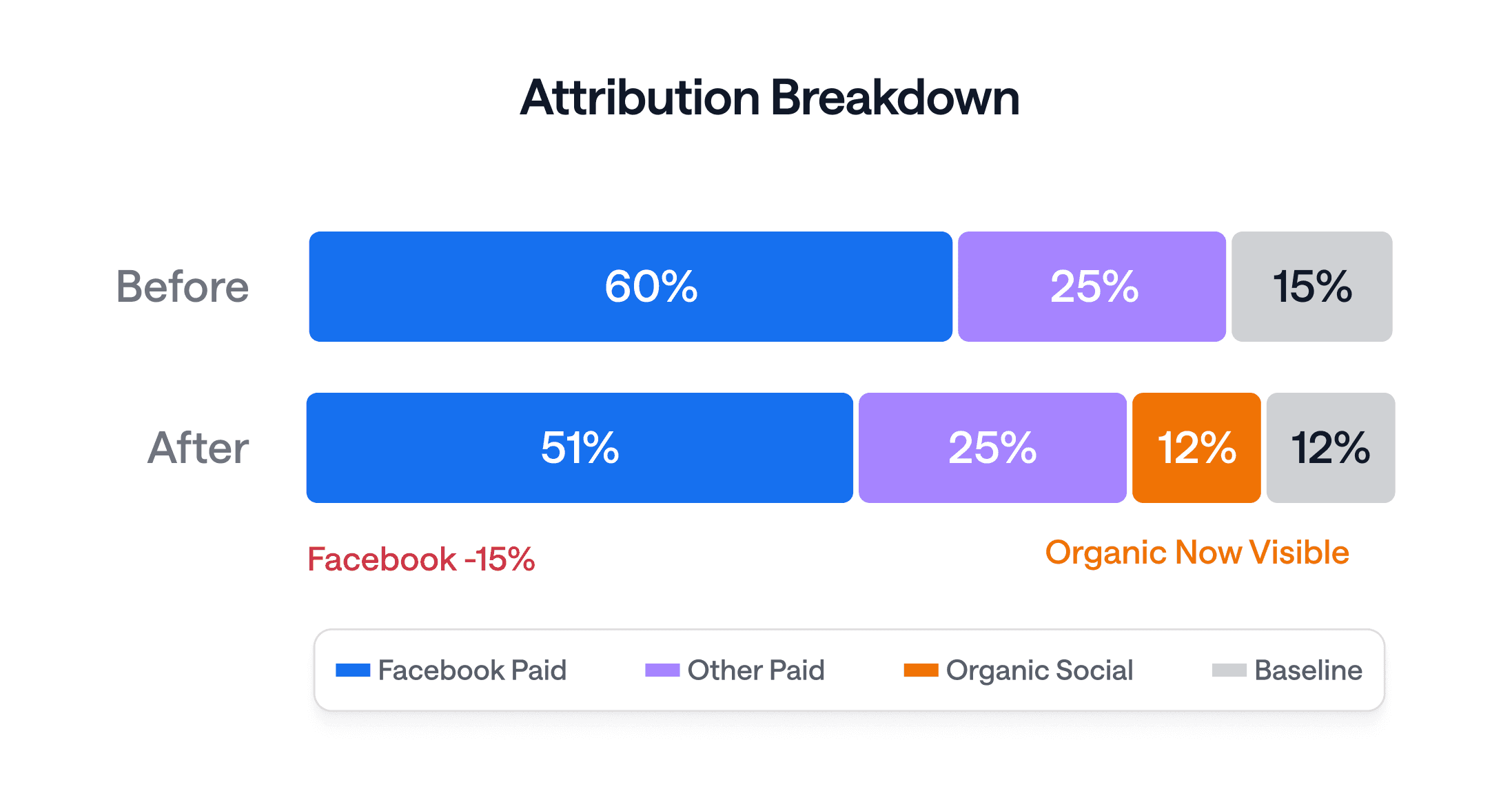

Organic social: Now represented ~20% of previously unexplained baseline attribution

Baseline shift: Without organic, baseline was ~$95K attributed. With organic social, that split into ~$80K baseline + ~$45K organic social = ~$125K total organic

Facebook reattribution: Some conversions previously credited to Facebook ads were correctly attributed to organic social activities - Facebook paid attribution dropped ~15%

For the first time, 1440 could see their organic investment in the same system as their paid investment. The days of "organic is unmeasurable" were over.

How adding organic social measurement changed 1440's attribution picture. ~15% of conversions previously credited to Facebook ads were correctly attributed to organic social efforts.

The Results: From Insight to Execution

BlueAlpha doesn't deliver reports. The system generates actions. Here's what 1440 executed based on model findings:

Immediate Actions

1. LiveIntent Shutdown (November 2025)

Model finding: Negative correlation with growth, quality "continued to go down" while costs increased

Action: Complete channel elimination

Reallocation: Budget moved to proven performers

2. Meta Scaling with Confidence

Model finding: "Strong+" correlation, lowest CAC, improving quality from Meta's "value-based" algorithm

Action: Scale to ~$650K/month with permission to keep spending if performance holds

Result: Growth continued tracking spend as predicted

3. Google PMax Elimination

Model finding: Weak correlation, poor performance after quality adjustment

Action: Turn off PMax

Quality-Adjusted Insights

The quality integration revealed counterintuitive truths:

Facebook: Raw Efficiency Rank 1st (lowest CAC) → Quality-Adjusted Rank: Still 1st (most incremental)

LiveIntent: Raw Efficiency Rank 3rd → Quality-Adjusted Rank: Dropped significantly

Beehiiv: Raw Efficiency Rank 5th → Quality-Adjusted Rank: Rose notably (4.4x higher quality than Google YouTube)

Google campaigns: Mixed raw efficiency → Quality-Adjusted: Performed more poorly after adjustment

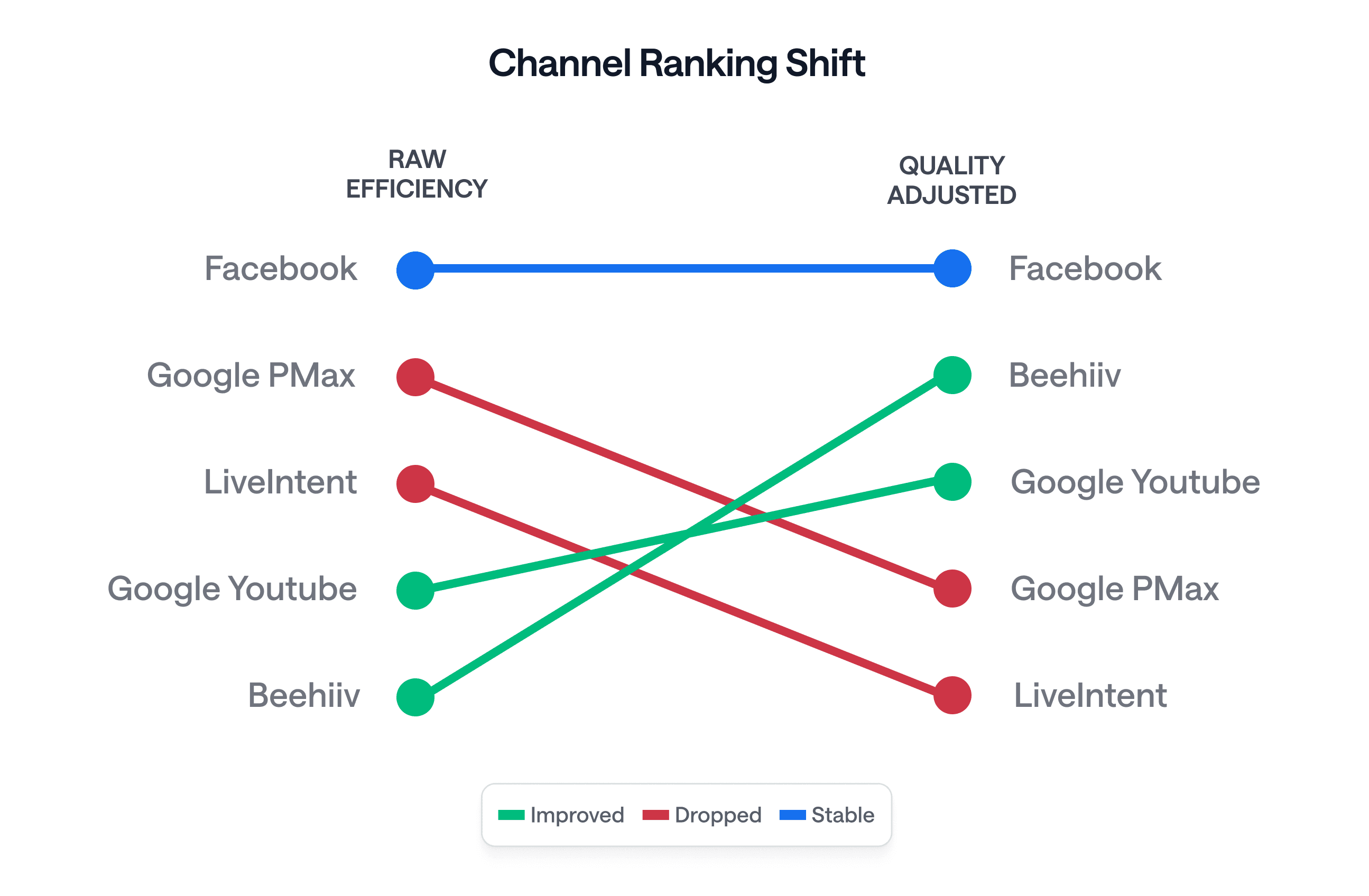

Before and after quality adjustment: LiveIntent and Beehiiv improved notably in incremental value, while Google campaigns dropped.

Operational Transformation

Beyond specific channel actions, BlueAlpha fundamentally changed how 1440 operates:

Weekly Office Hours: 25-minute check-ins with BlueAlpha data scientists and marketers to review model updates, discuss anomalies, and plan tests

Single Source of Truth: No more reconciling platform reports, GA4, and internal attribution - one unified model answers all questions

Decision Velocity: Budget discussions backed by weekly data, not quarterly guesswork

Organic Visibility: First-ever measurement of YouTube, Facebook, X, and Instagram organic contribution

Why It Worked: The Action System Difference

1. True Causal Measurement

BlueAlpha's Bayesian MMM doesn't just correlate - it identifies causation through spend variance analysis. When Facebook spend goes up and signups follow, then spend goes down and signups drop, the model captures that relationship with statistical rigor. The strong correlation isn't a guess - it's a probability-weighted measurement with uncertainty intervals.

2. Quality-First Economics

Most MMMs stop at "how many conversions?". BlueAlpha asks "how valuable are those conversions?". By integrating 1440's payback rate data directly into response curves, the system compares apples to apples. A channel might look efficient on raw CPA but terrible on revenue quality - or vice versa. 1440 now sees both dimensions simultaneously.

3. Weekly Refresh Velocity

Traditional MMMs are quarterly exercises. By the time insights reach decision-makers, market conditions have shifted. BlueAlpha's weekly updates meant 1440 could detect when Meta's new "value-based" algorithm started pushing higher-LTV cohorts - and respond immediately by increasing spend.

4. Organic Social Integration

Measuring organic has been marketing's white whale. BlueAlpha solved it by pulling engagement metrics from each organic platform and incorporating them as model variables. The result: organic social activities moved from "unmeasurable baseline" to "quantified channel contribution."

5. Radical Transparency

No black boxes. 1440's team can inspect priors, posteriors, diagnostics, and see exactly why a recommendation changed. When the model said "turn off LiveIntent," it wasn't blind faith - 1440 could trace the logic through correlation data, quality adjustments, and statistical confidence intervals.

What's Next: Scaling the Action System

1440's partnership with BlueAlpha continues with expanded testing and optimization:

Q1 2026 Testing Roadmap:

CTV: Top priority for upper-funnel expansion

TikTok Spark Ads: News content naturally fits the platform

YouTube Shorts: 5-second hooks targeting morning news seekers

Snapchat and Reddit: News-adjacent audiences with untapped potential

Ongoing Optimization:

Quality metric refinement

Systematic Meta scaling while monitoring for saturation signals

Continued organic social integration with additional API connections for expanded platform coverage

Key Takeaways for Newsletter and Media Companies

1. Platform metrics lie by omission. Facebook's reported conversions may be real, but they don't tell you if those conversions would have happened anyway. Only incrementality measurement reveals true channel value.

2. Correlation strength matters. A strong (over 9.0) correlation isn't just "good" - it's actionable evidence that justifies major budget decisions. Weak correlations (under 0.5) should trigger scrutiny, not scaling.

3. Quality adjustments change everything. Raw CPA rankings often flip when subscriber quality is factored in. Measure revenue value, not just acquisition cost.

4. Organic social is measurable. The "unmeasurable" label is outdated. Modern MMMs can incorporate organic engagement data and attribute conversions appropriately.

5. Speed beats precision. A weekly model that's 85% accurate enables faster learning than a quarterly model that's 95% accurate. Iteration velocity compounds.

6. Trust unlocks action. The most sophisticated measurement means nothing if leadership doesn't believe it. BlueAlpha's transparent methodology builds the confidence required to make bold decisions.

About BlueAlpha

Founded by former Tesla leaders, BlueAlpha is the marketing action system that transforms measurement into execution. We don't just tell you what happened - we tell you what to do next.

Our platform combines always-on incrementality testing, AI-powered decision engines, and human expertise to turn marketing chaos into strategic clarity. From newsletter growth to e-commerce revenue, we measure what matters and deliver the actions that drive growth.

We don't just measure. We execute.

Transform Your Marketing Measurement into an Action System

Ready to know - not guess - which channels actually drive your growth? Whether you're a newsletter scaling to millions, a D2C brand optimizing acquisition, or any growth team drowning in conflicting data, BlueAlpha turns measurement into decisions you can act on immediately.

See exactly which channels are working, which are wasting budget, and what to do next - backed by the same methodology that helped 1440 prove Meta's 0.934 correlation with subscriber growth.